Have you ever wondered if government agencies, like food stamps, have a way of monitoring your employment status? Well, wonder no more! The truth is, food stamps have a system in place to track your employment. So, if you’ve been on food stamps but are considering a job, you may be curious to know how this could impact your eligibility.

It’s a natural concern to have. After all, who doesn’t want to put food on the table for their family without relying on aid? But, it’s important to note that the rules around food stamps and employment are more nuanced than just the assumption that a job automatically disqualifies you. In fact, you may still be eligible for food stamps even if you start working. It all comes down to how much income you earn and your household size.

So, let’s dive in and explore how food stamps determine your eligibility once you start bringing home a paycheck. With some insider knowledge, you can make an informed decision about how and when to transition from food stamps to self-sufficiency.

How Food Stamps Work

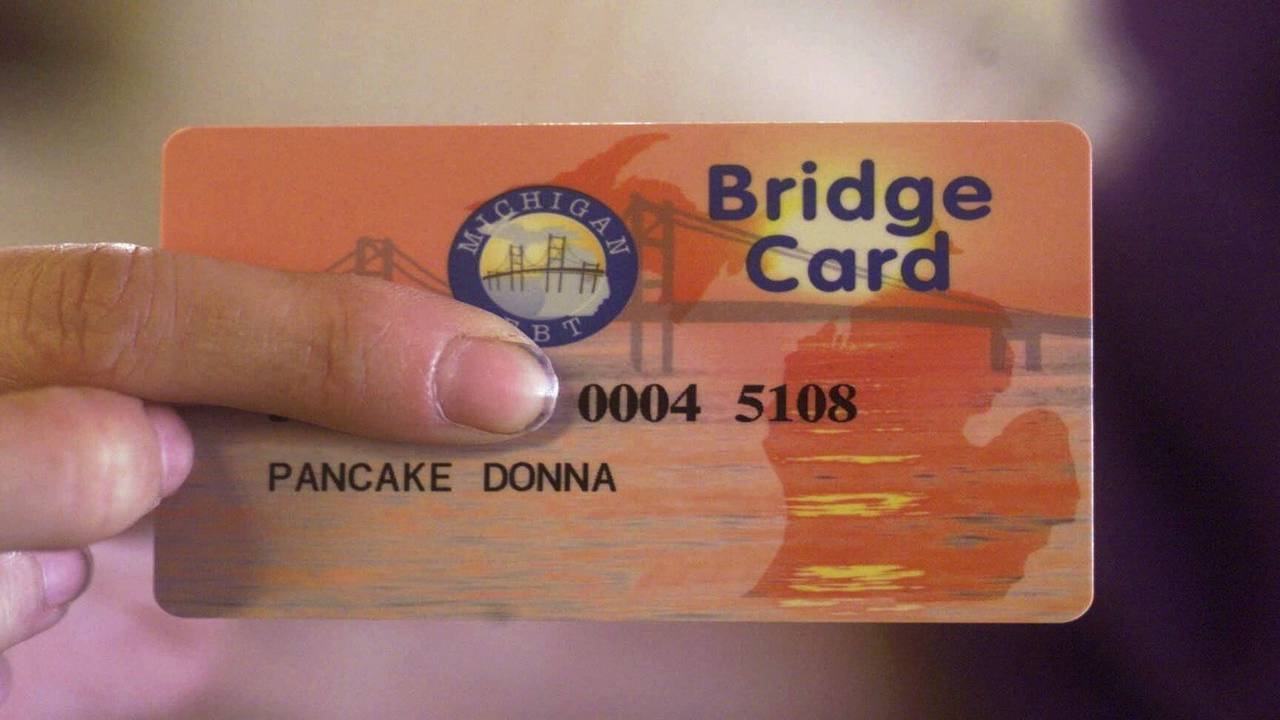

The Supplemental Nutrition Assistance Program, commonly known as food stamp benefits, is a federal program designed to help low-income individuals and families afford nutritious food. Every month, eligible households are given an electronic benefit transfer (EBT) card that works like a debit card to buy food items. The amount they receive depends on factors such as income, household size, and expenses.

- Eligibility: In order to be eligible for food stamp benefits, applicants must meet certain income and asset requirements. They also need to be a U.S. citizen or a legal noncitizen, have a social security number, and be working or looking for work.

- Application Process: Individuals can apply for food stamps either online, by mail, by phone, or in person at their local Department of Social Services. The application usually involves providing personal information, employment history, and financial documentation.

- Benefits: Once approved, individuals will receive their EBT card with their monthly benefits. They can use this card to buy eligible food items from authorized retailers, such as grocery stores or farmers’ markets.

It is important to note that the amount of benefits received may change based on changes in a household’s income, expenses, or size. Recipients are also required to report changes in their employment status and income to the program, as this may affect their eligibility. Failure to report accurately can result in fraud charges and a loss of benefits.

| Federal Poverty Level (FPL) | Maximum Gross Monthly Income (130% FPL) | Maximum Net Monthly Income (100% FPL) | Maximum Monthly Benefit for a Household of One |

|---|---|---|---|

| $1,063 | $1,383 | $1,064 | $194 |

| $1,437 | $1,869 | $1,437 | $234 |

| $1,810 | $2,357 | $1,810 | $375 |

Overall, food stamp benefits can provide much-needed assistance to those who are struggling to make ends meet. It is important to understand how the program works in order to make the most of the benefits received and to comply with the program’s regulations and reporting requirements.

Eligibility requirements for food stamps

Food stamps, officially known as the Supplemental Nutrition Assistance Program (SNAP), are a lifeline for millions of Americans struggling to put food on their tables. The eligibility requirements for SNAP are complex and can vary depending on the state you live in.

- Income: To be eligible for food stamps, your income must be at or below 130% of the poverty level. This equates to $16,744 for a single person and $34,588 for a family of four in 2021.

- Assets: SNAP has limits on the amount of assets you can own and still qualify for benefits. Your home, one car, and certain retirement accounts are exempt, but other assets like cash, stocks, and bonds can count towards your eligibility.

- Residency and citizenship: To receive food stamps, you must be a U.S. citizen or a legal permanent resident. You must also live in the state where you are applying for benefits.

- Work requirements: Able-bodied adults without dependents (ABAWDs) are subject to work requirements. This means that you must work at least 20 hours per week or participate in a work program to receive benefits for more than three months in a 36-month period.

It is important to note that receiving food stamps does not disqualify you from getting a job. However, if you do get a job, it may impact the amount of benefits you receive.

| Gross Monthly Income | Number of People in Household | Maximum Benefit |

|---|---|---|

| $0 to $1353 | 1 | $204 |

| $0 to $1825 | 2 | $374 |

| $0 to $2297 | 3 | $535 |

| $0 to $2769 | 4 | $680 |

In conclusion, eligibility requirements for food stamps are strict and can vary from state to state. It is important to understand the guidelines and requirements so that you can ensure you are receiving the benefits you need and are entitled to.

The SNAP Program

The Supplemental Nutrition Assistance Program (SNAP) is a federal program that helps low-income families and individuals purchase the food they need for good health. It is the largest food assistance program in the United States and provides benefits to nearly 40 million people each month.

What are the eligibility requirements for SNAP?

- Income: Households must meet income limits based on their size and income. The gross monthly income must be at or below 130% of the federal poverty level.

- Assets: Households must have limited assets. The asset limit is $2,250 for most households and $3,500 for households with an elderly or disabled member.

- Immigration status: Most non-citizens who are lawfully present in the United States are eligible for SNAP benefits. Undocumented immigrants are not eligible.

- Work requirement: Able-bodied adults without dependents (ABAWDs) must work or participate in a work program for at least 80 hours per month to receive SNAP benefits.

Will food stamps know if I get a job?

If you are receiving SNAP benefits and you start working, you are required to report your income and changes in household circumstances to your state’s SNAP agency. Failure to report changes may result in overpayment and you may be required to pay back the benefits. The state’s computer system may detect the change in income if your employer reports your wages to the state.

| Reporting requirements | Penalties for not reporting |

|---|---|

| Report your income and changes in household circumstances within 10 days of the change. | You may be required to repay the overpaid SNAP benefits and may be disqualified from SNAP for a period of time. |

| Provide documentation to verify your income and changes in household circumstances. | You may be required to repay the overpaid SNAP benefits and may be disqualified from SNAP for a period of time. |

It is important to comply with the SNAP program’s reporting requirements to avoid any penalties or disqualification from the program.

Reporting changes in income and employment status

As a recipient of food stamps, it is important to report any changes in income and employment status promptly.

Failure to report changes could lead to overpayments, underpayments, or even disqualification. Here are some important things to keep in mind when reporting income and employment status changes.

What changes should you report?

- Starting or losing a job

- Changes in work hours or wages

- Changes in other sources of income such as child support or disability payments

- Changes in household composition, such as births, marriages, or divorces

How to report changes?

Most states provide several options to report changes in income or employment status.

- Online – most states have an online portal where you can report changes.

- Mail – some states have a paper form that you can mail to the food stamp office.

- Phone – you can call the food stamp office and report the changes over the phone.

- In-person – some states allow you to visit the food stamp office and report the changes in person.

What happens if you don’t report changes?

If you fail to report changes, you could be subject to penalties such as being required to pay back overpayments or being disqualified from receiving food stamps for a period of time.

| Change Not Reported | Possible Penalties |

|---|---|

| Failure to report income increase | Owed money back to the food stamp program |

| Failure to report employment | Disqualified from receiving food stamps for a period of time |

| Failure to report a household member moving out | Overpaid for food stamps and have to pay back |

Reporting changes in income and employment status is an important responsibility of food stamp recipients. By reporting changes promptly, you can ensure that you are receiving the correct amount of food stamp benefits and avoid any penalties.

Consequences of not reporting changes in income and employment status

Many people receive food stamps because they have low or no income. However, if you get a job, your income will likely increase, which means that you may no longer be eligible for food stamps or that the amount you receive could be reduced. This is why it is extremely important to report any changes in your income or employment status to the food stamp office as soon as possible.

- If you do not report changes in your income or employment status, you could be committing fraud, which is a serious offense. If you are caught, you could face fines, jail time, or both.

- Not reporting changes in your income or employment status could also lead to an overpayment of benefits. This means that you could receive more benefits than you are entitled to. If this happens, you will likely be required to repay the excess benefits.

- If you fail to report changes in your income or employment status and continue to receive food stamps, you may be required to pay back all of the benefits you received for that period.

It is important to note that the food stamp office can access your tax records and employment information. This means that they will know if you have a job and how much you are earning. If you do not report this information, it will likely be discovered eventually. In addition to the consequences mentioned above, you could also be banned from receiving food stamps in the future.

If you are unsure about whether a change in your income or employment status affects your eligibility for food stamps, it is best to contact your local food stamp office to find out. They can provide you with information about the rules and regulations that apply to your situation.

| Consequences of not reporting changes in income and employment status: |

|---|

| – Committing fraud and facing fines or jail time |

| – Receiving an overpayment of benefits and having to repay the excess |

| – Being required to pay back all benefits received for the period of non-reporting |

| – Being banned from receiving food stamps in the future |

If you are struggling financially, it is understandable that you may want to hold onto every benefit you can. However, it is essential to be honest and report any changes in your income or employment status to the food stamp office. This will prevent you from facing serious consequences down the road.

How often a household must recertify for food stamps

In order to continue receiving food stamps, a household must recertify its eligibility on a regular basis. The frequency of recertification depends on several factors, including the household’s income, expenses, and other circumstances. Generally, households must recertify every 6 months or every year.

- If a household has no earned income at all, it only has to recertify every 12 months.

- If a household has earned income, but it is below a certain level, it can recertify every 6 months.

- If a household has earned income above a certain level, it must recertify every 6 months.

The recertification process involves providing updated information about the household’s income, expenses, and household composition. This information is used to determine whether the household is still eligible for food stamps and how much assistance it should receive. Failure to complete the recertification process on time can result in the household’s benefits being discontinued.

The timing and details of recertification may vary depending on the state in which the household resides. Some states may require households to complete additional steps, such as attending a meeting with a caseworker or providing documentation of expenses. It is important for households receiving food stamps to stay informed about the recertification requirements in their state and to follow the instructions provided by the program.

| Household Situation | Recertification Frequency |

|---|---|

| No earned income | 12 months |

| Earned income below certain level | 6 months |

| Earned income above certain level | 6 months |

Overall, the recertification process is an important part of the food stamp program to ensure that households are receiving the correct amount of assistance based on their current financial situation. Households should be aware of the requirements and deadlines for recertification and should seek assistance from the program if needed to complete the process on time.

The Role of Caseworkers in Overseeing Food Stamp Benefits

Food stamp benefits are intended to provide temporary assistance to households experiencing financial difficulties in purchasing food. Recipients must meet eligibility criteria, including income limits and other requirements, to qualify for benefits. The caseworkers employed by state agencies are responsible for verifying eligibility and overseeing the distribution of food stamp benefits.

- Caseworkers are tasked with determining the household’s eligibility for food stamp benefits. In addition to income, caseworkers may also consider household size, expenses, and other factors in determining eligibility.

- Once eligibility has been established, caseworkers are responsible for ensuring that recipients receive the appropriate amount of benefits. This includes calculating the amount of benefits to be provided and ensuring that recipients receive their benefits on time.

- Caseworkers also play a critical role in monitoring recipients’ circumstances to ensure continued eligibility. Recipients are required to report changes in their household, income, or expenses, and caseworkers are responsible for reviewing these reports and making any necessary adjustments to the food stamp benefits.

Caseworkers are also responsible for conducting periodic reviews to ensure that recipients remain eligible for food stamp benefits. This includes verifying income, expenses, and other eligibility criteria. Caseworkers may also conduct home visits to verify recipients’ circumstances.

Overall, caseworkers play a vital role in overseeing food stamp benefits and ensuring that they are distributed appropriately. They must balance the needs of recipients with the requirements of the program to ensure that the benefits are used to provide assistance to households in need of food assistance.

| Responsibilities of Caseworkers | |

|---|---|

| Determining eligibility for food stamp benefits | Ensuring appropriate distribution of benefits |

| Monitoring recipients’ circumstances for continued eligibility | Conducting periodic reviews and home visits |

It is important for recipients to cooperate with caseworkers and provide accurate information to ensure that they receive the appropriate amount of food stamp benefits. Failure to do so may result in a delay or denial of benefits.

Technology Used to Monitor Food Stamp Compliance

With the increase in technology, the government has implemented various systems to monitor compliance with food stamp rules. These technological advancements are aimed at reducing fraud and preventing misuse of the system. Here are some of the technology used to monitor food stamp compliance:

- Electronic Benefit Transfer (EBT) Cards: EBT cards are used to distribute food stamp benefits automatically to those who are eligible. They can be swiped like debit cards at participating retailers to purchase food items. EBT cards automatically track food purchases and identify any prohibited items.

- Automated Reporting Systems: Automated reporting systems are used by the government to cross-check client data with other databases to identify any discrepancies. If an individual is found to be receiving benefits illegally, their benefits will be terminated, and they may face legal action.

- Data Analytics: Data analytics is used to analyze patterns in food stamp usage. It can detect any unusual patterns that may indicate fraudulent activity. For example, if a client is purchasing large quantities of food or non-food items regularly, it may indicate that they are selling these items for cash, which is illegal.

One such advancement in monitoring food stamp compliance is the National Accuracy Clearinghouse (NAC), which is a reporting system that aims to prevent fraud and misuse of the system. With the implementation of NAC, states can report on their compliance with program rules, which will help detect fraud and improve program integrity.

Another impressive technology in monitoring food stamp compliance is the use of biometrics. Biometrics involves the use of fingerprints or facial recognition to verify the identity of food stamp recipients. This technology is still relatively new, but it is expected to become more prevalent in the future.

| Technology | Purpose |

|---|---|

| EBT Cards | To distribute benefits and track food purchases automatically |

| Automated Reporting Systems | To cross-check client data and identify discrepancies |

| Data Analytics | To analyze patterns in food stamp usage and detect fraudulent activity |

| NAC | To prevent fraud and improve program integrity |

| Biometrics | To verify the identity of food stamp recipients |

Overall, technology has revolutionized the way food stamp compliance is monitored. The advancements in this area have helped reduce fraud and protect taxpayers’ money by ensuring that the benefits are distributed fairly and only to those who are genuinely eligible.

Penalties for food stamp fraud

While many families rely on food stamps to put food on their tables, there are some individuals who engage in fraudulent activities to receive benefits that they are not entitled to. Fraudulent activities can come in many forms and is not limited to trafficking food stamps for cash. Failing to report income or falsifying information on an application are just a few examples of food stamp fraud that could result in heavy penalties.

- Fines: Those who are found guilty of food stamp fraud may be required to pay back the amount of benefits they received unlawfully. Additionally, they may be forced to pay a fine. The amount of the fine can vary depending on the severity of the fraud.

- Probation: Defendants may be required to serve a period of probation, during which they are expected to comply with all laws and regulations. Probation may last for several months or years, depending on the severity of the crime.

- Jail time: In some cases, individuals who have committed food stamp fraud may be sentenced to jail or prison time. Depending on the severity of the fraud and the defendant’s criminal record, the length of jail time can vary from a few months to several years.

In addition to these penalties, those convicted of food stamp fraud may also be banned from receiving food stamp benefits for a period of time. This can range from several months to permanent disqualification from the program.

It is important to note that being caught committing food stamp fraud can have long-term consequences that extend far beyond the immediate penalties. A fraud conviction can damage a person’s reputation and make it difficult for them to find employment or housing in the future.

Finally, it is essential to remember that the penalties for food stamp fraud are severe for a reason. These benefits are intended to help those who are in need. When individuals engage in fraudulent activities to receive benefits that they are not entitled to, they are taking away resources that could be going to families who truly need assistance.

| Penalties for food stamp fraud | Description |

|---|---|

| Fines | Defendants may be required to pay back the amount of benefits they received unlawfully and additional fines. |

| Probation | Defendants may be required to serve a period of probation and comply with all laws and regulations. |

| Jail time | Defendants may be sentenced to jail or prison time depending on the severity of the fraud and the defendant’s criminal record. |

| Banned from receiving benefits | Those convicted of food stamp fraud may be banned from receiving food stamp benefits for a period of time, ranging from several months to permanent disqualification. |

It is important to report suspected fraud immediately to prevent further abuse of the program and ensure that those who are in need receive the assistance they require.

Resources available for individuals seeking to transition off of food stamps.

Transitioning off of food stamps can be a challenging and overwhelming process, but there are numerous resources available to help ease the transition. Here are 10 helpful resources to take advantage of:

- The Supplemental Nutrition Assistance Program (SNAP) Work Requirements: Most food stamp recipients are required to participate in the SNAP Employment and Training (E&T) program. This program provides job training, education, and support services to help individuals gain employment and eventually transition off of food stamps.

- CareerOneStop: A website sponsored by the U.S. Department of Labor that provides resources for job seekers, including job search assistance, resume-building tools, and career exploration resources.

- Local job search agencies: Check with your local government or non-profit organizations for job search assistance and career counseling services.

- Federal student aid: If you’re interested in pursuing education and training to help you better transition off of food stamps, there are various federal student aid programs such as grants and loans offered to eligible individuals.

- Food banks: While not a direct form of employment assistance, food banks can help alleviate the cost of groceries and food, freeing up financial resources for job search and training-related expenses.

- Local libraries: Public libraries offer access to free internet and computer resources, which can be valuable for job search and research purposes.

- Non-profit organizations: There are many non-profit organizations dedicated to helping individuals gain employment and improve their financial situation. Research and reach out to relevant organizations in your area.

- Online resources: Websites like LinkedIn, Glassdoor, and Indeed can be helpful for job search and research purposes.

- Financial counseling services: Learning how to budget and manage finances can be an important part of transitioning off of food stamps. There are various financial counseling services available to help individuals improve their financial literacy and plan for the future.

- Government assistance programs: Depending on your circumstances, you may be eligible for various government assistance programs beyond food stamps, such as housing assistance and healthcare programs.

Workforce development programs

Workforce development programs are a critical resource for individuals looking to transition off of food stamps. These programs are designed to provide job training, education, and support services to help individuals improve their employability and gain employment. Most programs are focused on specific industries or skills, and offer a range of services including:

- Skills assessments

- Job search assistance

- Resume building and interview coaching

- On-the-job training and apprenticeships

- Education and training programs

- Career exploration resources

- Financial and supportive services

Workforce development programs are typically funded through federal, state, and local government agencies, as well as non-profit organizations and private companies. To find workforce development programs in your area, check with your local government, non-profit organizations, and online resources like CareerOneStop and the National Skills Coalition.

Employment and Training Program (SNAP E&T)

The SNAP Employment and Training (E&T) program is a federal program designed to provide job training, education, and supportive services to SNAP recipients who are able and willing to work. The program is aimed at helping individuals secure and retain employment, and eventually transition off of food stamps.

| Program components | Description |

|---|---|

| Basic education and skills training | Provides basic education and training in math, reading, and language skills. |

| Job search and placement services | Assists job seekers with job search strategies, job application and resume preparation, and job placement. |

| Work experience and on-the-job training | Provides work experience and on-the-job training to help individuals gain practical work experience and build job skills. |

| Employment and retention services | Provides ongoing support services designed to help individuals secure and retain employment, including transportation, child care, and work-related expenses. |

To participate in SNAP E&T, individuals must be receiving SNAP benefits and be required under SNAP rules to participate in a work-related activity. Participation in the program is voluntary, but may be required as a condition of receiving SNAP benefits. To learn more about SNAP E&T, contact your local SNAP office or visit the USDA Food and Nutrition Service website.

Cheers to a Fresh Start!

Well, there you have it – the answer to the million-dollar question! Yes indeed, if you land a job while on food stamps, your case worker will be notified of your increased earnings. However, with this newfound knowledge, you can take full advantage of all the resources and support available to you as you transition into a financially stable lifestyle. Remember, food stamps aren’t just a temporary solution, but a stepping stone to a brighter future. Thanks for reading and be sure to come back soon for more helpful tips and information!